China’s sovereign wealth fund, the China Investment Corporation (CIC), is significantly reducing its investments in Wall Street, triggering speculation about a strategic shift amidst escalating geopolitical tensions and economic recalibrations. The move, characterized by some as a “silent retreat,” involves the CIC, which manages over $1 trillion in assets, gradually pulling back from U.S. equities and other investments.

The decision reflects a broader trend among Chinese entities to diversify their holdings and reduce exposure to U.S. markets, fueled by concerns over regulatory scrutiny, trade disputes, and national security considerations. While the CIC has not publicly announced a wholesale withdrawal, industry insiders and financial analysts note a distinct deceleration in new investments and a strategic reallocation of existing assets towards other regions and sectors. This pivot raises questions about the future of Sino-American financial relations and the potential impact on global capital flows.

The shift by CIC represents a multifaceted strategy driven by both economic and political factors. “There’s definitely a move to reduce exposure to U.S. assets,” says a senior analyst at a global investment bank who requested anonymity due to the sensitivity of the matter. “The fund is under pressure to align its investments with national priorities and reduce vulnerabilities in an increasingly uncertain geopolitical landscape.”

One key driver behind the CIC’s recalibration is the heightened regulatory scrutiny faced by Chinese companies in the U.S. In recent years, Washington has intensified its oversight of foreign investments, particularly in sectors deemed critical to national security, such as technology and infrastructure. This increased scrutiny has made it more difficult and costly for Chinese firms to operate in the U.S., prompting many to re-evaluate their investment strategies.

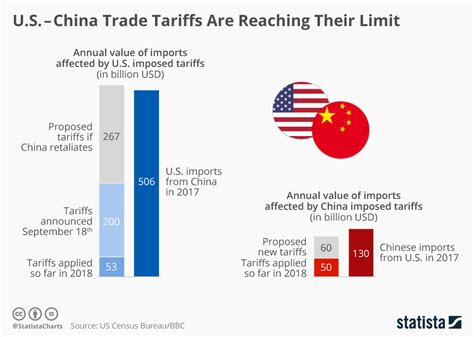

Furthermore, the ongoing trade tensions between the U.S. and China have added to the uncertainty surrounding Sino-American financial relations. The imposition of tariffs and other trade barriers has disrupted supply chains and eroded investor confidence, leading many Chinese entities to seek safer havens for their capital.

The CIC’s decision to reduce its exposure to U.S. markets is also driven by a desire to diversify its holdings and reduce its reliance on the dollar. In recent years, China has been actively promoting the internationalization of the renminbi and encouraging the use of its currency in international trade and investment. By diversifying its asset portfolio, the CIC aims to reduce its vulnerability to fluctuations in the value of the dollar and enhance its long-term financial stability.

Another factor influencing the CIC’s investment strategy is the changing economic landscape in China. The country’s economy is undergoing a structural transformation, shifting from an export-led model to one that is more reliant on domestic consumption and innovation. As part of this transformation, the Chinese government is encouraging investment in strategic sectors such as renewable energy, artificial intelligence, and advanced manufacturing. The CIC is therefore reallocating its assets to support these national priorities.

The implications of the CIC’s retreat from Wall Street are far-reaching. For the U.S., it could mean a reduction in foreign investment and a potential drag on economic growth. The CIC is one of the world’s largest sovereign wealth funds, and its investment decisions have a significant impact on global capital flows. A sustained reduction in its exposure to U.S. markets could put downward pressure on asset prices and increase borrowing costs.

However, some analysts argue that the impact of the CIC’s retreat will be limited. They point out that the U.S. economy is highly resilient and that there are many other sources of foreign investment. Furthermore, they argue that the CIC’s decision is driven by strategic considerations rather than a fundamental loss of confidence in the U.S. economy.

For China, the CIC’s retreat from Wall Street represents a strategic shift that could have significant implications for its long-term economic development. By diversifying its asset portfolio and reducing its reliance on the dollar, China is seeking to enhance its financial stability and reduce its vulnerability to external shocks. However, the shift also carries risks. It could lead to lower returns on investment and make it more difficult for Chinese firms to access capital.

The CIC’s actions are being closely watched by other sovereign wealth funds and institutional investors around the world. Its decision to reduce its exposure to U.S. markets could trigger a broader trend of diversification and reallocation of assets, with potentially significant consequences for global capital flows.

The move has been described as a “silent retreat” because the CIC has not made any official announcements about its plans. Instead, the fund has been quietly reducing its exposure to U.S. assets over the past few years. This has led to speculation about the reasons behind the move and the potential implications for the future of Sino-American financial relations.

“It’s not necessarily about a complete fire sale of assets,” explains another financial analyst. “It’s more about being very selective and strategic in where they deploy capital. Sectors deemed sensitive by the U.S. government are definitely being avoided.”

The sectors most affected by this pullback include technology, real estate, and infrastructure. These are areas where the U.S. government has expressed concerns about foreign ownership and control. The CIC is also reportedly reducing its investments in U.S. Treasury bonds, a move that could have implications for the dollar’s status as the world’s reserve currency.

Despite the reduction in investments, the CIC remains a significant player in the global financial markets. It continues to hold substantial assets in the U.S. and other countries, and it is actively seeking new investment opportunities in emerging markets and other regions.

The CIC’s shift in investment strategy reflects a broader trend among sovereign wealth funds to become more active and strategic investors. These funds are no longer content to passively hold assets in developed markets. They are increasingly seeking to invest in projects and companies that align with their national interests and that can generate higher returns.

The future of Sino-American financial relations is uncertain. The two countries are engaged in a complex and multifaceted relationship that is characterized by both cooperation and competition. The CIC’s retreat from Wall Street is just one example of the challenges and tensions that are shaping this relationship.

The implications of this “silent retreat” extend beyond mere financial figures. It underscores a growing unease within China regarding the stability and predictability of the U.S. investment climate. The concerns are not solely economic but also stem from a perceived increase in political risk, making long-term investment planning increasingly challenging.

One area of particular concern is the evolving regulatory landscape. New rules and regulations aimed at curbing foreign influence and protecting national security have made it more difficult for Chinese companies to operate in the U.S. These regulations have also increased the compliance costs for Chinese investors, making U.S. assets less attractive.

Another factor contributing to the CIC’s shift is the changing dynamics of the global economy. China is no longer solely focused on exporting goods and services to developed markets. It is increasingly looking inward, investing in its own domestic economy and expanding its presence in emerging markets. This shift in focus is reflected in the CIC’s investment strategy, which is now more geared towards supporting China’s national priorities.

The CIC’s retreat from Wall Street is not an isolated event. It is part of a broader trend of Chinese companies and investors reducing their exposure to U.S. assets. This trend is likely to continue in the years to come, as China seeks to diversify its holdings and reduce its reliance on the dollar.

The long-term impact of this trend on the U.S. economy is uncertain. Some analysts fear that it could lead to a decline in foreign investment and a slowdown in economic growth. Others argue that the U.S. economy is resilient and that it can withstand a reduction in Chinese investment.

Regardless of the long-term impact, the CIC’s retreat from Wall Street is a significant development that underscores the changing dynamics of the global economy and the evolving relationship between the U.S. and China. It serves as a reminder that the global financial landscape is constantly evolving and that investors must be prepared to adapt to new challenges and opportunities.

The CIC’s move is also viewed by some as a strategic maneuver to insulate itself from potential future sanctions or asset freezes, given the increasing geopolitical tensions. By reducing its footprint in U.S. markets, the fund aims to minimize its exposure to punitive measures that could be imposed in the event of a further deterioration in relations between the two countries.

Furthermore, the CIC is under increasing pressure from the Chinese government to invest in strategic sectors that are aligned with the country’s national development goals. This includes areas such as renewable energy, artificial intelligence, and advanced manufacturing. As a result, the fund is reallocating its assets to support these priorities, even if it means reducing its exposure to U.S. markets.

The shift in investment strategy also reflects a growing recognition within China that the U.S. economy is facing significant challenges. High levels of debt, rising interest rates, and a potential recession are all factors that are weighing on the U.S. economic outlook. As a result, the CIC is becoming more cautious about investing in U.S. assets, preferring to focus on markets that offer greater growth potential and lower risk.

The CIC’s retreat from Wall Street is a complex and multifaceted issue with no easy answers. It is driven by a combination of economic, political, and strategic factors, and it has the potential to have a significant impact on the global financial landscape.

While the CIC’s actions may be seen as a sign of growing tensions between the U.S. and China, it is important to remember that the two countries remain deeply interconnected. The U.S. is China’s largest trading partner, and China is a major holder of U.S. debt. Both countries have a vested interest in maintaining a stable and productive relationship.

However, the challenges facing the relationship are significant, and they are likely to persist in the years to come. The CIC’s retreat from Wall Street is just one example of the ways in which these challenges are playing out in the global financial markets.

Further Analysis and Context

The implications of the CIC’s “silent retreat” are far-reaching and warrant a more granular examination. Beyond the headline figures, several underlying factors contribute to this strategic realignment, and understanding these nuances is critical to grasping the full significance of the move.

1. Geopolitical Risk and De-risking Strategies: The intensifying geopolitical rivalry between the U.S. and China is a primary driver. The trade war initiated under the Trump administration, followed by continued scrutiny of Chinese tech companies and concerns over intellectual property theft, have created a climate of uncertainty. The CIC, like other state-backed entities, is acutely aware of the potential for sanctions or other punitive measures that could impact its U.S. holdings. De-risking, therefore, becomes a prudent strategy, reducing vulnerability to external political pressures.

2. Shifting Investment Priorities within China: China’s economic priorities are evolving. The focus is increasingly on achieving self-sufficiency in key technologies, promoting domestic consumption, and reducing reliance on exports. The “Made in China 2025” initiative, for example, aims to bolster domestic manufacturing and innovation in sectors like semiconductors, aerospace, and robotics. This necessitates directing capital towards these strategic industries, potentially at the expense of investments in foreign markets, including the U.S. The CIC is under increasing pressure to align its investment strategy with these national objectives.

3. Alternative Investment Destinations: While reducing exposure to U.S. markets, the CIC is actively seeking alternative investment destinations. Emerging markets in Asia, Africa, and Latin America offer promising growth opportunities, albeit with different risk profiles. Investments in infrastructure projects related to the Belt and Road Initiative (BRI) are also gaining prominence. These investments not only offer potential returns but also serve strategic objectives, expanding China’s economic and political influence across the globe.

4. Currency Considerations and Renminbi Internationalization: China has long sought to reduce its reliance on the U.S. dollar and promote the internationalization of the renminbi. Holding a large portion of its sovereign wealth in dollar-denominated assets exposes China to currency fluctuations and potential U.S. monetary policy decisions. Diversifying its currency holdings and promoting the use of the renminbi in international trade and finance are key objectives. Reducing investments in U.S. assets is one step in this direction.

5. Domestic Economic Conditions in the U.S.: The CIC’s investment decisions are also influenced by the economic outlook in the U.S. Concerns about rising inflation, high levels of debt, and the potential for a recession have made U.S. assets less attractive. The Federal Reserve’s interest rate hikes have further dampened investor sentiment. The CIC is likely reassessing its risk-adjusted returns on U.S. investments in light of these challenges.

6. Regulatory Burdens and Compliance Costs: Increased regulatory scrutiny in the U.S., particularly regarding foreign investments in sensitive sectors, has raised compliance costs and created uncertainty for Chinese investors. New rules and regulations aimed at protecting national security have made it more difficult and expensive for Chinese companies to operate in the U.S. This has prompted some to re-evaluate their investment strategies and seek more hospitable investment climates.

7. Long-Term Strategic Planning: Sovereign wealth funds like the CIC operate with a long-term investment horizon. Their decisions are not solely based on short-term market fluctuations but rather on long-term strategic considerations. The current geopolitical and economic landscape has prompted the CIC to reassess its long-term investment strategy and make adjustments to ensure that it aligns with China’s evolving national interests and economic priorities.

Impact Assessment:

The CIC’s “silent retreat” from Wall Street has several potential impacts:

- Reduced Capital Inflows to the U.S.: A reduction in Chinese investment could put downward pressure on U.S. asset prices and potentially increase borrowing costs. However, the U.S. economy is highly diversified, and other sources of foreign investment are available. The overall impact may be limited.

- Increased Investment in Emerging Markets: The CIC’s reallocation of assets could lead to increased investment in emerging markets, boosting economic growth and development in those regions.

- Accelerated Renminbi Internationalization: The move could accelerate the internationalization of the renminbi, as China seeks to reduce its reliance on the U.S. dollar.

- Shift in Global Power Dynamics: The CIC’s actions reflect a broader shift in global power dynamics, with China increasingly asserting its economic and political influence on the world stage.

- Heightened Geopolitical Tensions: The move could further exacerbate tensions between the U.S. and China, as each country seeks to protect its own interests.

Conclusion:

The CIC’s “silent retreat” from Wall Street is a significant development that reflects a complex interplay of economic, political, and strategic factors. It underscores the changing dynamics of the global economy and the evolving relationship between the U.S. and China. While the long-term implications are uncertain, the move serves as a reminder that the global financial landscape is constantly evolving and that investors must be prepared to adapt to new challenges and opportunities. The “silent retreat” is more than just a financial maneuver; it’s a strategic realignment that reflects a fundamental shift in China’s approach to global investment and its relationship with the United States.

Frequently Asked Questions (FAQ)

1. What is the China Investment Corporation (CIC)?

The China Investment Corporation (CIC) is China’s sovereign wealth fund, established in 2007. Its primary objective is to manage China’s foreign exchange reserves and seek long-term returns on investment. It manages over $1 trillion in assets and invests globally across various asset classes, including equities, fixed income, real estate, and alternative investments. “The fund is under pressure to align its investments with national priorities and reduce vulnerabilities in an increasingly uncertain geopolitical landscape,” according to a senior analyst.

2. Why is the CIC reducing its investments in Wall Street?

The CIC is reducing its investments in Wall Street due to a combination of factors, including heightened regulatory scrutiny of Chinese companies in the U.S., ongoing trade tensions between the U.S. and China, a desire to diversify its holdings and reduce its reliance on the dollar, and the changing economic landscape in China. The move is also seen as a strategic maneuver to insulate itself from potential future sanctions or asset freezes.

3. What sectors are most affected by the CIC’s pullback?

The sectors most affected by the CIC’s pullback include technology, real estate, and infrastructure. These are areas where the U.S. government has expressed concerns about foreign ownership and control. The CIC is also reportedly reducing its investments in U.S. Treasury bonds.

4. What are the potential implications of the CIC’s retreat for the U.S. economy?

The potential implications of the CIC’s retreat for the U.S. economy include a reduction in foreign investment, which could put downward pressure on asset prices and potentially increase borrowing costs. However, some analysts argue that the impact will be limited, as the U.S. economy is highly resilient and there are many other sources of foreign investment.

5. Is this retreat a sign of worsening relations between the U.S. and China?

While the CIC’s actions may be seen as a sign of growing tensions between the U.S. and China, it is important to remember that the two countries remain deeply interconnected. The U.S. is China’s largest trading partner, and China is a major holder of U.S. debt. Both countries have a vested interest in maintaining a stable and productive relationship. However, the challenges facing the relationship are significant, and they are likely to persist in the years to come. According to one financial analyst, “It’s not necessarily about a complete fire sale of assets. It’s more about being very selective and strategic in where they deploy capital. Sectors deemed sensitive by the U.S. government are definitely being avoided.”