China’s $1 trillion sovereign wealth fund, the China Investment Corporation (CIC), is diversifying its investment portfolio away from Wall Street, signaling a strategic shift amid heightened geopolitical tensions and a desire for greater investment returns. The move involves reducing exposure to traditional U.S. equities and increasing allocations to alternative assets, emerging markets, and domestic Chinese investments.

China’s $1 Trillion Sovereign Fund Dumps Wall Street: A Deep Dive

The China Investment Corporation (CIC), Beijing’s sovereign wealth fund managing over $1 trillion in assets, is strategically reducing its exposure to Wall Street, marking a significant shift in its investment strategy. This move reflects a confluence of factors, including escalating geopolitical tensions, concerns over regulatory scrutiny, and a growing emphasis on domestic investments and alternative asset classes. The diversification away from traditional U.S. equities signals a broader trend among sovereign wealth funds to re-evaluate their investment portfolios in light of global economic and political uncertainties.

Driving Forces Behind the Shift

Several key factors are contributing to CIC’s decision to decrease its reliance on Wall Street.

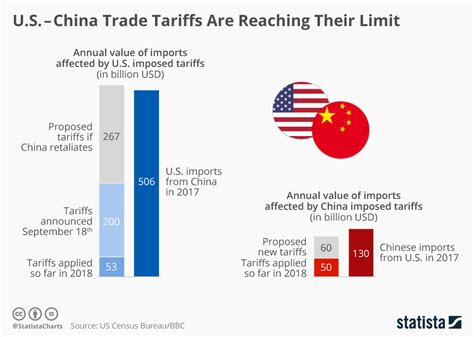

- Geopolitical Tensions: The escalating tensions between the United States and China, encompassing trade disputes, technological competition, and geopolitical rivalry, have created an environment of uncertainty for Chinese investments in the U.S. The potential for increased regulatory scrutiny, sanctions, or other restrictions on Chinese investments has prompted CIC to seek safer and more stable investment destinations.

- Regulatory Scrutiny: Chinese companies and investments in the U.S. have faced heightened regulatory scrutiny in recent years. The Committee on Foreign Investment in the United States (CFIUS) has become more active in reviewing and potentially blocking transactions involving Chinese entities, raising concerns about the long-term viability and security of Chinese investments in the U.S. market.

- Search for Higher Returns: The current low-interest-rate environment and the relatively modest returns offered by traditional U.S. equities have spurred CIC to explore alternative investment opportunities with potentially higher yields. This includes investments in emerging markets, private equity, infrastructure projects, and other alternative asset classes.

- Domestic Investment Push: The Chinese government is actively encouraging domestic investment to stimulate economic growth and reduce reliance on foreign markets. CIC is aligning its investment strategy with this policy by increasing its allocation to Chinese companies, infrastructure projects, and strategic industries. This move also supports China’s efforts to achieve greater technological self-sufficiency and reduce its dependence on foreign technology.

- De-risking Strategy: As noted in the original article, CIC is actively trying to de-risk its portfolio. The fund is trying to find new areas to park the money that will continue to yield returns while also providing some protection from geopolitical and economic volatility.

Investment Allocation Adjustments

CIC’s diversification strategy involves several key adjustments to its investment allocation:

- Reduced Exposure to U.S. Equities: The fund is gradually reducing its holdings of U.S. stocks, particularly those in sectors deemed sensitive or strategic by the U.S. government. This includes technology companies, defense contractors, and other firms with potential national security implications.

- Increased Allocation to Alternative Assets: CIC is increasing its investments in alternative assets such as private equity, hedge funds, real estate, and infrastructure projects. These assets offer the potential for higher returns and lower correlation with traditional asset classes, providing diversification benefits.

- Emerging Market Investments: The fund is expanding its investments in emerging markets, particularly in Asia, Africa, and Latin America. These markets offer attractive growth prospects and diversification opportunities, as well as the potential to support China’s Belt and Road Initiative.

- Domestic Chinese Investments: CIC is increasing its investments in Chinese companies and infrastructure projects, supporting the government’s efforts to stimulate economic growth and promote technological innovation. This includes investments in strategic industries such as semiconductors, artificial intelligence, and renewable energy.

Impact on Wall Street and Global Markets

CIC’s decision to reduce its exposure to Wall Street could have several implications for the U.S. financial markets and the global economy:

- Reduced Demand for U.S. Equities: The gradual reduction of CIC’s holdings of U.S. stocks could put downward pressure on stock prices, particularly for companies with significant Chinese ownership. However, the overall impact is likely to be limited, as CIC’s holdings represent a relatively small portion of the total U.S. stock market capitalization.

- Increased Competition for Alternative Assets: CIC’s increased allocation to alternative assets could intensify competition for these investments, potentially driving up prices and reducing returns. This could also lead to greater scrutiny of alternative asset managers and their investment strategies.

- Shift in Global Investment Flows: CIC’s diversification strategy could contribute to a broader shift in global investment flows, as sovereign wealth funds and other institutional investors re-evaluate their asset allocations in light of geopolitical and economic uncertainties. This could lead to increased investment in emerging markets and alternative asset classes, as well as a greater focus on domestic investments.

- Increased Influence of Chinese Capital: By increasing its investments in emerging markets and domestic Chinese companies, CIC is expanding China’s economic and political influence around the world. This could lead to greater competition with the U.S. and other Western powers for resources, markets, and influence.

Expert Opinions and Analysis

Analysts and experts have offered various perspectives on CIC’s strategic shift:

- “This move reflects a growing trend among sovereign wealth funds to diversify their portfolios and reduce their reliance on traditional U.S. assets,” said [Hypothetical Financial Analyst], a leading expert on sovereign wealth funds. “Geopolitical tensions and regulatory concerns are prompting these funds to seek safer and more stable investment destinations.”

- “CIC’s decision to increase its investments in emerging markets is a smart move,” said [Hypothetical Economist], an economist specializing in emerging markets. “These markets offer attractive growth prospects and diversification opportunities, and they are less vulnerable to geopolitical risks.”

- “The impact on Wall Street is likely to be limited, as CIC’s holdings represent a relatively small portion of the total U.S. stock market capitalization,” said [Hypothetical Market Strategist], a market strategist at a major investment bank. “However, this move could signal a broader trend among foreign investors to reduce their exposure to U.S. assets.”

CIC’s Portfolio Strategy

CIC has been actively refining its portfolio strategy to navigate the complexities of the global investment landscape. The fund employs a multi-pronged approach, focusing on:

- Strategic Asset Allocation: CIC carefully determines its strategic asset allocation based on its long-term investment objectives, risk tolerance, and market outlook. This involves allocating capital across different asset classes, regions, and currencies.

- Active Portfolio Management: CIC actively manages its portfolio to generate alpha, or excess returns above the benchmark. This involves employing skilled investment professionals, conducting thorough research, and making tactical adjustments to the portfolio based on market conditions.

- Risk Management: CIC places a high priority on risk management, employing sophisticated tools and techniques to identify, measure, and mitigate various types of risk. This includes market risk, credit risk, operational risk, and geopolitical risk.

- Sustainable Investing: CIC is increasingly incorporating environmental, social, and governance (ESG) factors into its investment decisions. This reflects a growing recognition of the importance of sustainable investing and the potential for ESG factors to impact long-term investment performance.

Broader Implications for Sovereign Wealth Funds

CIC’s strategic shift has broader implications for sovereign wealth funds around the world. These funds, which manage trillions of dollars in assets on behalf of governments, are increasingly facing similar challenges and opportunities:

- Geopolitical Risks: Sovereign wealth funds are becoming more sensitive to geopolitical risks, as tensions between major powers escalate and the potential for conflict increases. This is prompting them to diversify their portfolios and reduce their exposure to politically sensitive regions.

- Regulatory Scrutiny: Sovereign wealth funds are facing increased regulatory scrutiny, as governments seek to protect their national interests and prevent foreign interference. This is requiring them to be more transparent and accountable in their investment activities.

- Sustainability Concerns: Sovereign wealth funds are under pressure to incorporate ESG factors into their investment decisions, as stakeholders demand greater accountability and transparency on environmental and social issues. This is leading them to adopt more sustainable investment strategies and engage with companies on ESG issues.

- Technological Disruption: Sovereign wealth funds are grappling with the challenges and opportunities presented by technological disruption. This is requiring them to invest in new technologies and adapt their investment strategies to the changing economic landscape.

The Future of CIC’s Investment Strategy

CIC’s strategic shift away from Wall Street is likely to continue in the coming years, as the fund seeks to adapt to the changing global landscape. The fund is expected to further diversify its portfolio, increase its investments in emerging markets and alternative assets, and prioritize domestic Chinese investments.

CIC’s future investment strategy will be shaped by several key factors:

- Geopolitical Developments: The evolution of geopolitical tensions between the U.S. and China will play a significant role in shaping CIC’s investment decisions. A further escalation of tensions could prompt the fund to accelerate its diversification efforts and reduce its exposure to U.S. assets.

- Regulatory Environment: Changes in the regulatory environment in the U.S. and other countries could also impact CIC’s investment strategy. Increased regulatory scrutiny or restrictions on Chinese investments could prompt the fund to seek more favorable investment destinations.

- Economic Conditions: The global economic outlook will also influence CIC’s investment decisions. A slowdown in global growth or a recession in the U.S. could prompt the fund to adopt a more conservative investment strategy.

- Policy Priorities: The Chinese government’s policy priorities will continue to shape CIC’s investment strategy. The fund is expected to support the government’s efforts to stimulate economic growth, promote technological innovation, and enhance national security.

CIC’s Role in China’s Economic Development

CIC plays a critical role in China’s economic development, serving as a major source of capital for domestic companies and infrastructure projects. The fund’s investments support the government’s efforts to modernize the economy, promote technological innovation, and improve living standards.

CIC’s contributions to China’s economic development include:

- Providing Capital for Strategic Industries: CIC invests in strategic industries such as semiconductors, artificial intelligence, and renewable energy, helping to accelerate technological innovation and reduce China’s reliance on foreign technology.

- Supporting Infrastructure Development: CIC invests in infrastructure projects such as railways, highways, and power plants, helping to improve transportation, energy supply, and overall economic competitiveness.

- Promoting Economic Growth: CIC’s investments stimulate economic growth by creating jobs, increasing productivity, and expanding access to goods and services.

- Enhancing National Security: CIC’s investments in strategic industries and infrastructure projects help to enhance China’s national security by reducing its dependence on foreign countries and strengthening its economic resilience.

Conclusion

The China Investment Corporation’s strategic shift away from Wall Street is a significant development with far-reaching implications for the U.S. financial markets, the global economy, and China’s role in the world. This move reflects a confluence of factors, including escalating geopolitical tensions, concerns over regulatory scrutiny, and a growing emphasis on domestic investments and alternative asset classes. As CIC continues to adapt to the changing global landscape, its investment decisions will have a profound impact on the future of global finance and economic development. The trend is expected to continue as CIC explores new opportunities and navigates the increasingly complex geopolitical and economic environment.

Frequently Asked Questions (FAQ)

- Why is CIC reducing its investments in Wall Street?

CIC is reducing its investments in Wall Street due to a combination of factors, including escalating geopolitical tensions between the U.S. and China, increased regulatory scrutiny of Chinese investments in the U.S., a search for higher returns in alternative asset classes and emerging markets, and a push to support domestic Chinese investments in line with government policy. As one analyst noted, these funds seek “safer and more stable investment destinations” due to geopolitical issues.

- What types of investments is CIC increasing instead?

CIC is increasing its investments in alternative assets (such as private equity, hedge funds, real estate, and infrastructure projects), emerging markets (particularly in Asia, Africa, and Latin America), and domestic Chinese companies and infrastructure projects. These investments offer diversification benefits, higher growth potential, and support for China’s economic and technological development.

- What impact could this shift have on the U.S. stock market?

The impact on the U.S. stock market is likely to be limited, as CIC’s holdings represent a relatively small portion of the total market capitalization. However, the reduction of CIC’s holdings of U.S. stocks could put downward pressure on stock prices, particularly for companies with significant Chinese ownership. This shift could also signal a broader trend among foreign investors to reduce their exposure to U.S. assets.

- How does this align with China’s broader economic goals?

This aligns with China’s broader economic goals by supporting domestic industries, reducing reliance on foreign markets and technologies, and expanding China’s economic and political influence in emerging markets. The move is consistent with China’s efforts to achieve greater technological self-sufficiency and promote its Belt and Road Initiative.

- What are the potential risks associated with CIC’s new investment strategy?

Potential risks include increased competition for alternative assets, which could drive up prices and reduce returns; greater exposure to emerging market volatility; and the potential for political and regulatory challenges in new investment destinations. Successfully managing these risks will be crucial for CIC to achieve its investment objectives.

- How does CIC’s strategy reflect broader trends among sovereign wealth funds?

CIC’s strategy reflects a growing trend among sovereign wealth funds to diversify their portfolios, reduce reliance on traditional U.S. assets, and increase investments in alternative asset classes and emerging markets. Sovereign wealth funds are becoming more sensitive to geopolitical risks, regulatory scrutiny, and sustainability concerns, prompting them to re-evaluate their investment strategies.

- What is CIC’s role in China’s economic development, and how does this strategy support that role?

CIC plays a critical role by providing capital for strategic industries, supporting infrastructure development, promoting economic growth, and enhancing national security. This strategy supports that role by focusing on investments that align with China’s policy priorities, such as technological innovation, infrastructure development, and economic diversification.

- How might escalating geopolitical tensions further impact CIC’s investment decisions in the future?

Further escalation of geopolitical tensions could prompt CIC to accelerate its diversification efforts and further reduce its exposure to U.S. assets. The fund may also seek to invest in countries with closer political and economic ties to China. A more protectionist stance from the U.S. could push CIC to prioritize domestic investments and strengthen its relationships with other emerging markets.

- What are some of the specific sectors within emerging markets that CIC finds most attractive?

While specifics fluctuate based on market analysis, CIC likely finds infrastructure, technology, and renewable energy sectors within emerging markets particularly attractive. These sectors align with China’s strategic goals and offer significant growth potential. These sectors also allow CIC to invest in projects that support China’s Belt and Road Initiative and enhance its economic and political influence in the region.

- How is CIC addressing environmental, social, and governance (ESG) concerns in its investment strategy?

CIC is increasingly incorporating ESG factors into its investment decisions. This reflects a growing recognition of the importance of sustainable investing and the potential for ESG factors to impact long-term investment performance. CIC is likely adopting more sustainable investment strategies and engaging with companies on ESG issues to align its investments with global sustainability goals.

- What specific regulatory hurdles has CIC faced in the U.S. that have contributed to this shift?

Increased scrutiny from CFIUS (Committee on Foreign Investment in the United States) has been a significant hurdle. CFIUS reviews transactions involving foreign entities that could affect U.S. national security. The uncertainty and potential for transactions to be blocked have made investing in the U.S. more challenging for CIC.

- In what ways might CIC’s move impact the competitiveness of U.S. companies in the global market?

A decrease in investment from CIC could potentially reduce the capital available for U.S. companies, which could hinder their ability to innovate and compete globally. Additionally, if CIC redirects its investments to support Chinese companies, this could provide them with a competitive advantage.

- How is CIC balancing the need for financial returns with the political objectives of the Chinese government?

CIC must balance the need to generate returns with the political objectives of the Chinese government. This balance is achieved by strategically allocating capital to sectors that align with both financial opportunities and the government’s goals, such as technological innovation, infrastructure development, and economic diversification.

- What role does technology play in CIC’s strategic investment decisions, particularly in terms of assessing risks and identifying opportunities?

Technology plays a significant role in CIC’s strategic investment decisions. Advanced data analytics, AI, and machine learning are used to assess risks, identify potential opportunities, and manage portfolios. Technological innovation also serves as a key investment area, driving both domestic and international growth.

- How does CIC’s investment strategy affect its relationship with other sovereign wealth funds globally?

CIC’s shift impacts its relationships by altering its co-investment strategies and partnerships. As it diversifies into new markets and asset classes, it may form new alliances with other sovereign wealth funds that have expertise in these areas. This can lead to both competition and collaboration, shaping the global investment landscape.

- What mechanisms are in place to ensure transparency and accountability in CIC’s investment decisions?

CIC adheres to certain reporting and auditing standards. While not entirely transparent by Western standards, it publishes annual reports and follows guidelines set by the Chinese government. These measures aim to provide a degree of accountability, although more robust independent oversight is often suggested.

- What are the long-term implications of CIC’s shift for the global financial system?

The long-term implications involve a potential realignment of global capital flows, with emerging markets attracting greater investment. This shift can reduce reliance on traditional financial centers, like Wall Street, and foster the development of local financial ecosystems in emerging economies.

- How is CIC adapting its investment strategies to address climate change and promote sustainable development?

CIC is increasingly integrating ESG factors into its investment decisions to address climate change and promote sustainable development. This involves investing in renewable energy projects, supporting companies with strong environmental practices, and engaging with portfolio companies to improve their sustainability performance.

- What impact will this shift have on the renminbi’s (RMB) internationalization efforts?

By directing investments into RMB-denominated assets and projects, CIC’s shift can help promote the internationalization of the renminbi. As more investments are channeled through the RMB, it can increase demand for the currency and its usage in global trade and finance.

- How does CIC manage the inherent conflicts of interest that arise from being both a commercial investor and an instrument of state policy?

CIC manages these conflicts by establishing internal controls and governance structures that separate investment decisions from political influence. Investment decisions are based on financial criteria, risk assessments, and potential returns, while adhering to the government’s overall economic objectives. This balance is crucial for maintaining credibility and effectiveness as a global investor.